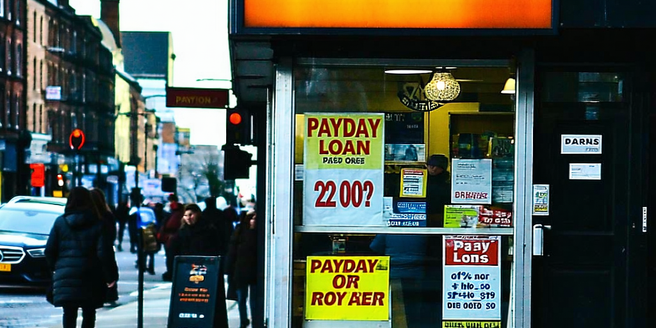

Understanding Payday Loans: Basic Overview

Payday loans are short-term, high-interest loans meant to provide immediate cash to borrowers in need of quick financial relief. Typically, these loans are due by the borrower’s next payday and are accessible to individuals with less-than-perfect credit scores. While payday loans can offer timely financial assistance, they often come with significant risks, including steep fees and interest rates that can trap borrowers in a cycle of debt. Understanding the basic operation of payday loans involves recognizing their high cost structure and potential for penalties if not repaid promptly. Borrowers should be mindful that due to these high expenses, payday loans might not be the most economical option when facing cash shortages. More awareness and education regarding these loans can help prospective borrowers make informed decisions.

History and Evolution of Payday Loan Regulations

The history of payday loan regulations has evolved substantially over the decades. Initially emerging as a lending solution for short-term financial needs, payday loans soon became controversial due to their high costs and frequent use as a rollover option by borrowers. In response, consumer advocacy groups began pushing for stricter laws to protect borrowers from exploitative lenders. Early regulations were sparse, allowing predatory lending practices to proliferate, which led to increased borrower debt. Over time, the demand for reform grew, prompting states and federal authorities to implement greater oversight. The introduction of interest rate caps, restrictions on loan amounts, and the formation of consumer protection agencies marked significant steps in regulatory evolution. By understanding the trajectory of these regulations, one gains insight into how legislative measures have endeavored to balance consumer protection with ensuring access to emergency funds.

Key Federal Laws Governing Payday Loans

Key federal laws governing payday loans aim to protect consumers from predatory lending practices while ensuring access to needed financial services. The Dodd-Frank Wall Street Reform and Consumer Protection Act played a pivotal role in enhancing regulatory oversight, primarily through the Consumer Financial Protection Bureau (CFPB). Importantly, these laws are constantly reviewed and updated to adapt to the evolving financial landscape and consumer needs. As a result, the CFPB has enacted rules to prevent unfair, deceptive, or abusive acts, focusing on transparency and fair treatment. Additionally, the Truth in Lending Act mandates lenders disclose critical loan terms, including fees and APRs, ensuring that consumers are adequately informed pre-borrowing. By enforcing these laws, federal agencies strive to prevent exploitative lending while promoting transparency and competitive practices.

State-by-State Payday Loan Regulation Differences

Payday loan regulations vary significantly across the United States, with each state imposing its rules to address local concerns. Some states opt for strict controls, capping interest rates and loan amounts to protect residents from exploitative lending. For example, states like New York and usury law states prohibit payday loans entirely, citing their high-risk nature. In contrast, others, such as Texas, permit payday loans with fewer restrictions, resulting in higher fees and risks for borrowers. Additionally, many consumer advocacy groups are pushing for more uniform federal regulations to ensure fair lending practices nationwide. Understanding these state-by-state differences is crucial for borrowers who must navigate varying legal landscapes depending on their location. Such awareness can help consumers make better-informed decisions, considering both protections and risks involved in their respective states.

How Payday Loan Regulations Affect Borrowers

Payday loan regulations have profound effects on borrowers, influencing both their borrowing decisions and financial outcomes. For instance, restrictive laws that cap interest rates can help prevent debt spirals by lowering the cost of borrowing. Moreover, these regulations can also encourage financial institutions to offer more competitive and consumer-friendly loan products. Conversely, lenient regulations might lead to higher fees and interest rates, trapping borrowers in cycles of debt. Regulatory environments also impact the availability of loans, with tighter controls potentially reducing the number of lenders. This can limit borrower access to emergency funding, pushing some individuals to seek alternative high-cost options. As such, understanding the regulatory landscape is vital for borrowers to navigate their options, ensuring they avoid exploitative practices while accessing the funds needed for financial stability.

Consumer Rights When Taking Out a Payday Loan

Consumers have specific rights when taking out a payday loan to protect them from unfair practices. These rights include full disclosure of loan terms, rates, and total costs before borrowing, allowing individuals to make informed decisions. Lenders are required by law to explain these terms clearly and must not engage in abusive collection practices. It’s crucial for consumers to read all documentation thoroughly to ensure they fully understand the terms of the loan. Consumers also have the right to rescind a payday loan within a limited timeframe without incurring penalties. Furthermore, consumers can file complaints with state or federal authorities if they suspect illegal or unethical lender behavior. Knowing these rights empowers borrowers to safeguard themselves from predatory lending and make educated choices regarding their borrowing needs.

Recognizing and Reporting Illegal Payday Lending

Recognizing and reporting illegal payday lending is crucial for consumer protection and ensuring fair lending practices. Illegitimate lenders often bypass consumer rights, charging excessive fees or interest rates, and employing abusive collection tactics. Indicators of illegal operations can include a lack of transparency in loan terms, unlicensed lenders, and requests for upfront fees. It’s a growing issue that demands collective awareness and action. It’s important for consumers to stay informed about their rights to prevent falling victim to such predatory practices. Consumers suspecting illegal activity should report these practices to regulatory bodies like the Consumer Financial Protection Bureau or state attorney general’s office. Reporting not only aids in personal resolution but also helps regulate the broader industry, deterring unlawful practices and promoting a safer borrowing environment.

Alternatives to Payday Loans: Safer Borrowing Options

Several alternatives to payday loans offer safer borrowing options that reduce financial risk for consumers in need. Credit unions often provide small-dollar loan programs with more affordable interest rates than payday loans. Furthermore, it’s important to research and compare options before committing to any loan. Consulting with a financial advisor may also provide valuable insights when considering different borrowing options. Additionally, some online lenders offer installment loans with flexible terms and lower costs. Financial coaching and budgeting assistance from nonprofit organizations can also support individuals in managing shortfalls without resorting to high-cost lenders. Employers may offer payroll advances as a low-cost alternative, while community resources like churches and charities might provide emergency assistance. Exploring these alternatives can help borrowers access necessary funds without the burdensome debt associated with payday loans.

Future Trends in Payday Loan Legislation

Anticipated future trends in payday loan legislation may focus on heightened consumer protection and decreasing lender exploitability. Advances in technology could offer innovative platforms for more transparent and fair loan processes. Financial experts believe that emerging fintech solutions could revolutionize the way consumers access short-term credit. This transformation has the potential to make borrowing more accessible and less burdensome for millions of people. As these fintech solutions develop, security and privacy will become paramount to ensure consumer trust. Expected legislative changes might include capping interest rates nationwide, standardizing loan terms, and promoting alternative lending solutions like community-based programs. Additionally, increased attention to financial literacy education could empower consumers to make informed decisions. As regulatory frameworks evolve, balancing access to emergency funds with safeguarding borrower interests will remain a crucial focus, driving a more equitable financial landscape across the nation.