Understanding Bad Credit and Its Impact on Lending

| Factor | Explanation | Impact on Lending |

| Credit Score | A measure of creditworthiness. | High scores improve loan opportunities. |

| Credit History | Summary of past credit behavior. | Negatives can lead to higher interest rates. |

| Debt-to-Income Ratio | Comparison of debt payments to income. | Lenders prefer lower ratios. |

| Delinquencies | Late payments on debts. | Can decrease creditworthiness. |

| Loan Type | Different loans have distinct terms. | Secured loans might offer better terms. |

| Economic Conditions | State of the economy influences lending. | Recessions tighten credit availability. |

The Importance of Vetting Lenders

When considering taking out a loan, the importance of vetting lenders cannot be overstated. It’s a crucial step that ensures you choose a lender who is credible, trustworthy, and offers terms that align with your financial goals. With an abundance of lending options available, from traditional banks to online platforms and peer-to-peer networks, one can easily become overwhelmed. Vetting allows borrowers to differentiate between reputable lenders and potential scams. It involves researching a lender’s credibility, understanding their fee structures, and reading reviews from other borrowers. Additionally, evaluating a lender’s customer service can reveal how they handle issues and client interactions. A lender that is transparent about terms and fees will likely provide a more secure borrowing experience. Ultimately, thorough vetting empowers you to make informed decisions, protecting your financial health and ensuring that your borrowing experience is both safe and beneficial.

Identifying Legitimate Lenders for Bad Credit

When navigating the tricky waters of securing a loan with bad credit, distinguishing legitimate lenders from predatory ones becomes crucial. A low credit score shouldn’t automatically force you into unfair agreements. Begin by scrutinizing the lender’s credentials. Verify that they are registered and authorized by national financial regulatory bodies. A legitimate lender will have a transparent website that clearly outlines loan terms, interest rates, and any associated fees. Additionally, reputable lenders often conduct a soft credit check first to give a preliminary offer, helping you avoid unnecessary credit score impacts. Be cautious of lenders who promise guaranteed approval without assessing your financial situation; this is often a red flag. Look out for online reviews and consumer feedback to assess other borrowers’ experiences. Lastly, consider consulting a financial advisor to ensure you’re making an informed decision.

Evaluating Interest Rates and Loan Terms

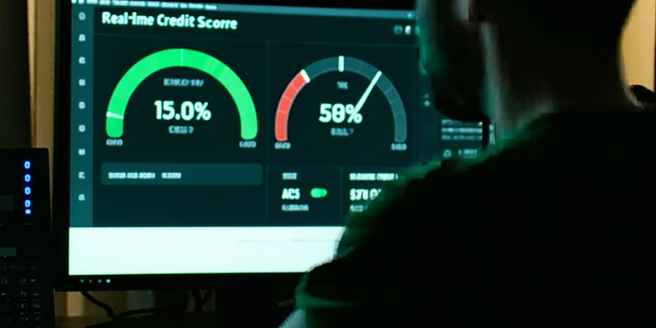

When evaluating interest rates and loan terms, it’s crucial to comprehend how these factors influence your financial health. Interest rates, often expressed as an annual percentage rate (APR), determine the cost of borrowing. A lower APR generally means lower monthly payments and reduced overall loan cost. However, it’s essential to consider the loan period. Longer loan terms may offer smaller monthly payments but often result in paying more interest over time. Additionally, evaluate the type of interest rate: fixed or variable. Fixed rates remain constant, providing stability in budgeting, while variable rates might start lower but can fluctuate, potentially increasing costs. Assessing loan terms also involves understanding any fees, penalties for early repayment, and the lender’s flexibility in adjusting terms if your financial situation changes. Carefully balancing these aspects can lead to informed decisions that align with your financial goals.

Recognizing Warning Signs of Predatory Lending

Predatory lending often targets individuals in vulnerable financial situations, promising quick and easy solutions while concealing harmful consequences. Recognizing the warning signs is crucial to protect yourself from potential financial disaster. One major red flag is excessively high-interest rates that far exceed the norm for the type of loan or credit, often making it nearly impossible for borrowers to keep up with payments. Equally alarming are lenders who require upfront fees for processing or insurance, which legitimate lenders typically do not do. Another sign is a lack of transparency in the loan terms; if a lender is unwilling or unable to clearly explain the terms and conditions, it suggests they might be hiding something detrimental. Additionally, if a lender pressures you to act quickly without giving you time to consider or seek advice, it’s often a manipulation tactic meant to trap you.

Checking Lender Credibility and Reputation

When considering a financial commitment like taking a loan, it’s crucial to thoroughly evaluate the credibility and reputation of potential lenders. This step not only ensures your financial safety but also grants peace of mind during the borrowing process. Start by examining online reviews and ratings across credible platforms, such as the Better Business Bureau or Trustpilot, to gauge the experiences of other borrowers. Pay close attention to recurring issues or praises; these patterns can provide valuable insights into a lender’s business practices. It’s also wise to ensure that the lender is registered and regulated by relevant financial authorities, which shields you against predatory lending practices. Additionally, seek recommendations from friends or family members who have successfully borrowed in the past. Remember, a reputable lender will be transparent regarding terms and conditions, and will not pressure you into hurried decisions.

Comparing Loan Offers and Conditions

When comparing loan offers and conditions, it’s crucial to look beyond the surface interest rates and delve into the finer print that could significantly impact your financial commitment. The annual percentage rate (APR) is often touted as a comprehensive measure of a loan’s cost, as it incorporates interest rates along with any additional lender fees. However, potential borrowers should also assess repayment terms, penalty clauses for early repayments, and any potential introductory rate changes. Another critical aspect is the loan type; fixed-rate loans offer stability with consistent payments, whereas variable-rate loans might start with lower payments that could rise. Additionally, evaluating the lender’s reputation and customer service can be beneficial, as good communication can greatly alleviate the stress of managing a loan. By taking a holistic approach, you can choose a loan that aligns with your financial goals and circumstances, ensuring both affordability and peace of mind.

Leveraging Online Reviews and Testimonials

In today’s digital age, harnessing the power of online reviews and testimonials can set your business apart in a crowded marketplace. Reviews serve as a modern-day word-of-mouth, providing potential customers with genuine insights into your products or services. By actively encouraging satisfied customers to share their experiences on platforms like Yelp, Google, or industry-specific sites, companies can enhance credibility and build trust. It’s crucial to engage with all reviews, both positive and negative, to showcase excellent customer service and a commitment to improvement. Highlighting testimonials prominently on your website can also boost conversion rates by offering social proof that resonates with visitors. Utilizing user-generated content not only reinforces your brand’s reputation but also aids in SEO efforts, driving traffic and fostering community engagement. Embracing this feedback loop ultimately transforms reviews into invaluable marketing tools.

Utilizing Financial Advisors and Experts

In today’s complex financial landscape, leveraging the expertise of financial advisors and experts can be a game-changer for both individuals and businesses. Financial advisors bring to the table a deep understanding of market trends, investment strategies, and tax optimization techniques. By collaborating with these professionals, you gain access to personalized financial plans tailored to your short-term needs and long-term goals. Whether you’re planning for retirement, saving for your children’s education, or looking to grow your investment portfolio, an advisor provides insights and strategies that align with your financial aspirations. Moreover, they can help you navigate the ever-evolving regulations and economic conditions with confidence, ensuring you stay on track even amidst market fluctuations. Entrusting your financial planning to a seasoned advisor not only saves time and effort but also brings peace of mind, allowing you to focus on what truly matters in life.

Securing a Loan with Confidence and Safety

Securing a loan is a significant financial step that requires not only confidence but also a sense of security. For many, the process can seem daunting, but understanding the key factors can transform this experience into an empowering journey. First, it’s crucial to assess your financial health by reviewing your credit score, income, and expenditures. This self-awareness will guide you in choosing the right loan type and amount. Research various lenders, comparing interest rates and terms to ensure you find the most favorable option. It’s equally important to communicate directly with potential lenders to clarify any concerns and build trust. Ensuring all your documentation, like proof of income and identification, is meticulously prepared, enhances your credibility. Remember, confidence in obtaining a loan stems from being informed and prepared. By blending diligence with strategic planning, you can secure a loan safely, setting the stage for financial growth.