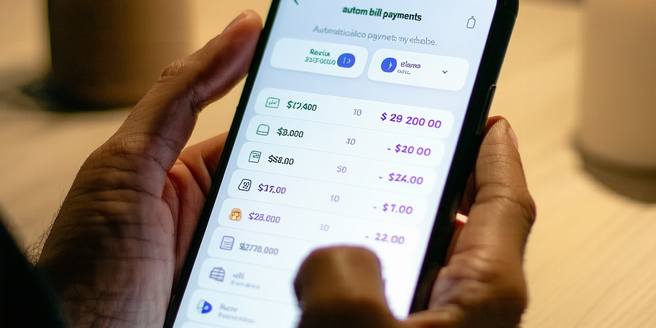

Understanding Automatic Payments

| Concept | Description | Example |

| Setup Process | How to initiate automatic payments | Setting up through bank |

| Recurring Payments | Repeatedly scheduling payments | Monthly subscription |

| Security Measures | Protecting financial data | Password protection |

| Payment Methods | Various ways to pay | Credit card or bank draft |

| Cancellation Policy | How to stop payments | Contacting provider |

| Terms and Conditions | Rules governing payments | Read before agreeing |

Convenience and Time-Saving

In today’s fast-paced world, convenience is paramount. Automatic payments eliminate the need for manual transactions, allowing you to set it once and forget it. This process not only frees up time but reduces the mental load of remembering due dates. Additionally, it offers the added security of avoiding late fees, which can have long-term financial implications. With automatic payments, you can easily manage multiple accounts within a few minutes, thus saving considerable time each month. The seamless nature of these payments ensures that you never miss a payment, reducing stress and letting you focus on more important tasks. Plus, by relying on automated processes, you can benefit from timely payments without the inconvenience of writing checks or visiting payment centers.

Enhanced Financial Management

Automatic payments play a vital role in improving your financial management skills. By leveraging these systems, you gain a clearer picture of your monthly finances without the surprise of forgotten expenses. The consistent scheduling helps create a predictable cash flow, which simplifies budgeting efforts. Automated systems can also save you time and reduce stress associated with managing multiple accounts. You’ll also gain access to records of payments, making it easier to track expenditure and assess spending patterns. This visibility assists in making informed financial decisions, while automatic payments ensure bills are prioritized, reducing the risk of overspending on non-essentials. The organized nature of automatic transactions ensures that you stay on top of your financial obligations effortlessly.

Reducing Late Payment Fees

Late payment fees can significantly impact your budget and financial standing. Utilizing technology to handle routine tasks can also free up your time for more important matters. Automatic payments help prevent these unnecessary charges by ensuring that payments are made on time, every time. By automating the payment process, you eliminate the risk of human error or oversight in forgetting due dates. Many people find that setting up alerts and reminders alongside automatic payments provides an additional layer of assurance. Financial institutions often offer automatic payment discounts or waive late fees, which can result in long-term savings. Embracing automatic payments is a proactive strategy that guarantees punctuality, thus enhancing your reputation with creditors and maintaining a positive credit profile while enjoying added peace of mind.

Improved Credit Score

Maintaining a good credit score is essential for future financial endeavors. Automatic payments contribute to a healthy credit score by ensuring that bills are paid on time, which is a crucial component of credit scoring models. Incorporating automatic payments can also help you avoid late fees, thereby saving money in the long run. Consistent on-time payments reflect positively on your credit report, signaling creditworthiness and reliability to lenders. Over time, this can enhance your credit score, allowing you to qualify for better interest rates and credit opportunities. Automatic payments serve as a fail-safe that strengthens your financial reputation and fosters trust with financial institutions, leading to more favorable credit terms and conditions.

Environmentally Friendly Option

Automatic payments can greatly reduce your environmental footprint. By opting for digital transactions, you diminish the need for paper bills, checks, and receipts. This shift not only saves trees but also reduces the carbon emissions involved in mailing physical statements. Many banks and service providers now offer incentives for customers who choose paperless billing. Furthermore, it enhances efficiency by ensuring bills are paid on time without manual intervention. The reduction in paper usage aligns with the growing global emphasis on sustainability, reflecting a conscientious approach to managing finances. Adopting automatic payments is a small yet impactful step towards a greener planet, and it encourages more eco-friendly practices in personal finance management. The convenience of going paperless complements the broader environmental benefits.

Increased Security and Reliability

Security is a primary concern when it comes to financial transactions. Automatic payments enhance security by utilizing encrypted channels for transaction processing, thus safeguarding your sensitive data. These transactions are not only secure but reliable, ensuring that payments are processed consistently at the scheduled times. With automatic payments, users can rest assured that their financial information is well-protected. The convenience of automatic payments helps users manage their finances more efficiently. Unlike manual methods, which can be prone to fraud or errors, automatic payments are protected by advanced security measures. Users can also set up notifications for payment processing, adding an extra layer of security and reassurance. Automatic payments provide peace of mind by prioritizing security in handling your transactions.

Budgeting and Financial Planning

Effective budgeting and financial planning are facilitated by the regularity and predictability of automatic payments. By establishing fixed payment schedules, there is greater consistency in your outgoing expenses, allowing for accurate budgeting each month. Automatic payments enable more straightforward tracking of finances, accounting for recurring payments without manual intervention. It also reduces the risk of missing important due dates, which can lead to unnecessary fees or penalties. With this system, you can gain a clearer understanding of your cash flow and financial obligations. This predictability means that your financial plans are less prone to disruption, and unexpected expenses are managed more efficiently. Incorporating automatic payments into your financial routine ensures that budgeting efforts remain disciplined and accurate, fostering better financial health and future preparedness.

Flexibility in Payment Scheduling

Automatic payments offer flexibility by allowing you to choose payment dates that align with your financial schedule. This flexibility ensures that payments can be timed to coincide with your cash flow, reducing the risk of overdrafts or financial strain. Additionally, they can provide peace of mind by automating routine financial tasks. In addition, automatic payments can help you avoid late fees by ensuring timely transactions. Many providers offer customizable options, allowing adjustments to payment dates and frequencies as needed. The ability to adapt payment schedules fosters financial agility and control, accommodating changes in income or expenditures. Automatic payments’ inherent flexibility accommodates personal financial circumstances, ensuring smooth, hassle-free transaction management without compromising your financial stability.

Streamlined Record Keeping

Record keeping is a critical component of effective financial management, and automatic payments simplify this process. Automated transactions generate electronic records that are easy to access and organize. These records provide a clear, concise history of payments, making it straightforward to review past financial activities. Additionally, they ensure that important financial data isn’t lost or misplaced. Moreover, automatic payments help reduce the risk of human error in financial data entry. This built-in record-keeping ability aids in preparing financial documents, tracking expenses, and reconciling accounts. Access to comprehensive records through automatic payments supports transparency and accuracy in financial reporting, fostering greater confidence in financial affairs and facilitating easier financial audits and reviews when necessary.