Understanding Cash Advances and Their Purpose

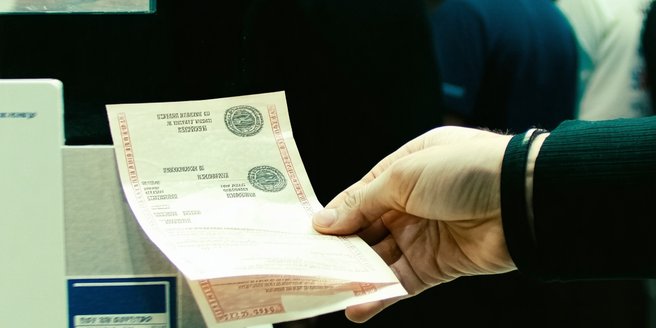

| Aspect | Description | Example |

| Definition | Short-term loan to cover emergency expenses. | Borrowing $500 for car repairs. |

| Purpose | To bridge financial gaps until the next paycheck. | Paying rent when income is delayed. |

| Usage | Typically used for urgent bills or emergencies. | Medical expenses not covered by insurance. |

| Repayment | Usually due by next pay period with interest. | Payback on payday with fees. |

| Eligibility | Must have a consistent income and ID. | Steady job and government-issued ID. |

| Considerations | Evaluate the cost and necessity before applying. | Compare interest rates and fees. |

The Importance of Financial Planning for Cash Advances

Financial planning is crucial when considering a cash advance. This ensures that you can manage your existing expenses while planning to repay the borrowed amount promptly. Without proper planning, you risk entering a cycle of debt, as cash advances often come with high interest rates and fees. By assessing your monthly income and expenses, you can determine if a cash advance is a viable solution or if alternative options may be more appropriate. Furthermore, financial planning helps in setting realistic repayment timelines and aims to minimize long-term financial strain. Take the time to compare different cash advance providers and their terms to choose the best option tailored to your needs. A well-thought-out financial strategy not only gives you peace of mind but also reinforces your ability to manage unforeseen expenses responsibly and effectively.

Assessing Your Current Financial Situation

Before diving into any financial commitments, it’s vital to assess your current financial situation. This involves closely examining your income streams and monthly expenses to understand your cash flow better. Start by listing all sources of income, including salary, side gigs, or any passive income. Then, document your fixed and variable expenses, from rent and utilities to groceries and entertainment. Understanding these components gives you a clear picture of your financial health and highlights areas for improvement or adjustments. This assessment can help identify whether you can sustain additional financial commitments such as a cash advance without jeopardizing your financial stability. It also assists in recognizing patterns that may need correction, such as overspending in certain areas, allowing you to make more informed financial decisions.

Steps to Create an Effective Budget

Creating an effective budget is essential for managing your finances, especially when considering tools like cash advances. Start by defining clear financial goals, such as saving for a specific purpose, reducing debt, or simply living within your means. Next, allocate portions of your income to different categories—essentials like housing and food, savings or investments, and discretionary spending. It’s important to track and review your spending regularly, adjusting your budget as necessary to reflect any changes in income or expenses. Utilize tools like budgeting apps or spreadsheets to simplify the process and ensure accuracy. Remember, the goal of a budget is not to restrict your spending but to make sure your money works effectively towards your financial goals. Regular evaluations help in staying aligned with your objectives and adapting to any changes in your financial landscape.

Strategies to Improve Your Credit Score

Improving your credit score is a prudent financial move that can benefit you if you need a cash advance. Begin by regularly checking your credit report to identify any discrepancies or errors that need correction. On-time bill payments are crucial, as late payments can significantly impact your score. It’s advisable to reduce outstanding debts, particularly high-interest credit card balances, and keep credit utilization low. Another effective strategy is to become an authorized user on accounts with good standing or opening a secured credit card to build your credit history. Ensure that you limit new credit inquiries, as too many can negatively affect your score. Over time, consistent financial responsibility will lead to a higher credit score, offering better terms and interest rates when applying for loans or advances. This proactive approach isn’t just beneficial for acquiring financial products but also establishes a strong foundational financial health.

How to Calculate the Right Amount for a Cash Advance

Calculating the right amount for a cash advance involves understanding your financial needs and repayment capabilities. Start by determining the specific expense the cash advance is meant to cover, such as a medical bill or urgent home repair. Next, evaluate your monthly budget to understand how much you can realistically afford to repay, considering fees and interest rates. It’s crucial not to borrow more than necessary to minimize the debt. Take into account your income and allocate part of it towards the cash advance repayment, ensuring it won’t affect your ability to meet essential living expenses. Tools like loan calculators can provide estimates on repayment amounts and terms, considering your financial commitments. Being strategic about the amount you seek to advance ensures that you’re not placing yourself in a financially precarious position, allowing you to manage your financial obligations effectively.

Risks and Benefits of Taking a Cash Advance

Taking a cash advance comes with both risks and benefits. On the benefit side, it provides immediate access to cash, which can be crucial in emergency situations where quick financial assistance is needed. It can also help bridge temporary gaps in finances until the next paycheck. However, the risks involve the high fees and interest rates associated with cash advances, which can lead to a cycle of debt if not managed properly. Additionally, defaulting on a cash advance can negatively impact your credit score, making future borrowing more difficult. It’s important to carefully weigh these factors and ensure thorough planning prior to taking out a cash advance. Understanding these dynamics helps in making more informed decisions, ensuring that you utilize cash advances responsibly and effectively to support your financial needs without unnecessary risk.

Comparing Different Cash Advance Providers

When it comes to selecting a cash advance provider, comparing your options is key to finding the best fit for your needs. Look into the interest rates and fees charged by different providers, as these can vary significantly and impact the total cost of borrowing. Consider the repayment terms offered and whether they align with your financial capabilities. It’s also beneficial to read customer reviews to gauge the reliability and quality of service of a provider. Make sure the provider is transparent about all costs involved and does not have hidden charges. Evaluating these factors thoroughly will assist in identifying a reputable provider that offers fair terms and conditions. Keep in mind that some providers might offer incentives or discounts for new customers, so it’s worth exploring all possible options before making a decision.

Tips for Getting Approved for a Cash Advance

Getting approved for a cash advance often requires meeting certain eligibility criteria. A consistent income source is a primary requirement, as it reassures the lender of your ability to repay. Ensure that your credit score is in good standing, as higher scores improve approval chances and terms. Prepare necessary documentation, such as ID and proof of income, to streamline the application process. It’s advised to maintain low existing debt levels to show responsible financial management. Some providers may also value a stable employment history, so note the duration of your current job tenure. Choosing the amount wisely and being prepared with a repayment plan can also positively influence approval, indicating to the lender that you’ve given careful thought to your financial decisions. By following these tips, you enhance your chances of approval while ensuring you’re ready to meet the obligations of a cash advance.

Alternatives to Cash Advances for Financial Needs

While cash advances can be beneficial, exploring alternative options may offer more favorable terms. Consider borrowing from friends or family, which may come interest-free and with flexible repayment. Another alternative is a personal loan from a bank or credit union, typically featuring lower interest rates and structured repayment plans. Balance transfer credit cards offer a short-term solution with lower interest rates if used wisely. Some employers offer salary advances as another route to access needed funds. Additionally, exploring community resources or assistance programs for specific financial needs may provide relief without the need for borrowing. This diversified approach to managing financial needs can afford more traditional repayment solutions without the risks typically associated with cash advances, ensuring you’re able to manage financial shortfalls effectively without undue stress.