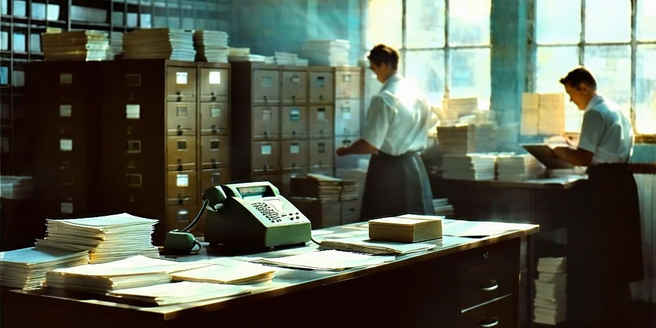

Early Days: Manual Evaluations and Paperwork

| Year | Process | Challenges |

| 1950s | In-person applications | Time-intensive |

| 1960s | Manual calculations | Human error |

| 1970s | Paper documentation | Storage issues |

| 1980s | Initial digital systems | Technical limitations |

| 1990s | Increased automation | Integration challenges |

The Rise of Credit Scoring Systems

Credit scoring systems emerged as a revolutionary tool in the loan approval process. Before credit scoring, lending decisions were primarily subjective and based on the lender’s personal judgment. The introduction of credit scores provided an objective measure of a borrower’s creditworthiness using historical data. Fair, Isaac, and Company (FICO) played a pivotal role in developing a standardized scoring system, which rapidly became an industry norm. These scores enabled lenders to quickly evaluate potential customers based on factors like payment history, debt levels, and credit inquiries. Consequently, this system expedited decision-making processes and reduced approval times. The reliability and efficiency offered by credit scores transformed them into a core component of the financial landscape, ultimately making loan approvals more streamlined, accessible, and impartial. This transition not only facilitated increased lending opportunities but also allowed borrowers to improve their scores and secure better loan terms.

Advent of Online Loan Applications

The advent of the internet revolutionized the loan application process by introducing online platforms. This development allowed borrowers to submit applications at their convenience without the need for physical presence at a lender’s office. Online applications provided greater accessibility to borrowers in remote areas and facilitated a faster application process. With digital forms, data entry became more efficient, significantly reducing paperwork and manual errors. Additionally, online platforms offered easy access to information and further transparency regarding terms and conditions. Lenders could instantly receive application data, enabling quicker evaluations and responses. Furthermore, the integration of digital verification processes streamlined authentication procedures, ensuring more secure and reliable identity checks. Thus, the shift to online loan applications marked a significant step forward in enhancing user experience, improving operational efficiencies for lenders, and broadening the reach of financial services to a wider audience.

Automation in Data Verification

Automation transformed data verification in loan approval processes by minimizing human intervention and errors. With automated systems, data submitted by applicants can be cross-checked with existing databases, such as credit bureaus and employment records, in a matter of seconds. This efficiency not only sped up the approval process but also enhanced accuracy. The use of document recognition technology further enabled verification of documents like pay stubs and tax returns, reducing the reliance on manual checks. Automation ensures that applications are processed consistently and that anomalies or red flags can be swiftly identified. In addition, eliminating redundant tasks freed up resources, allowing staff to focus on complex cases requiring human judgment. Ultimately, automation in data verification contributed to a faster turnaround time, higher accuracy, and increased operational capabilities, benefiting both lenders and borrowers in the loan approval landscape.

The Role of Artificial Intelligence

Artificial Intelligence (AI) plays a major role in transforming the loan approval process by introducing sophisticated decision-making capabilities. AI algorithms can analyze vast datasets, identifying patterns and trends that human evaluators might overlook. This enables lenders to assess risk more comprehensively and make predictive evaluations of an applicant’s creditworthiness. AI-driven chatbots are employed to assist potential borrowers, providing information and guiding them through application procedures. Furthermore, AI provides insights by analyzing social media and other non-traditional data sources to evaluate borrower behavior. These technologies contribute to more informed and fair lending decisions, while also offering opportunities for financial inclusion of underserved populations. AI inevitably speeds up approval cycles and enhances customer satisfaction due to increased personalization and faster service. As a result, AI continues to reshape how lenders conduct business by improving accuracy, reducing costs, and driving innovation in the approval process.

Machine Learning Enhancements in Risk Assessment

Machine learning enhances risk assessment by enabling more precise and nuanced analysis of potential borrowers. Traditional credit assessments relied heavily on static variables like income and past credit usage. However, machine learning models are capable of evaluating a broader set of variables, such as transaction patterns and spending behavior, to provide a comprehensive risk profile. These algorithms learn and adapt over time, continuously refining their predictions based on new data inputs. Consequently, they can offer real-time evaluations and respond dynamically to emerging trends, which helps lenders mitigate risks more effectively. Machine learning’s ability to deliver deep insights into borrower behavior empowers lenders to make informed decisions, granting credit responsibly while minimizing exposure to defaults. This advanced approach to risk management results in more accurate assessments, improved loan performance, and a greater ability to serve a diverse population with tailored financial products.

Integration of Blockchain Technology

Blockchain technology integration in loan approval processes offers enhanced security, transparency, and efficiency. By maintaining decentralized, immutable records, blockchain ensures that loan-related data is secure from alterations and unauthorized access. The transparency of blockchain allows all parties involved in the loan process to verify transactions and data in real-time, fostering trust and accountability. Smart contracts—self-executing agreements with terms directly written into code—facilitate automatic execution of loan terms once predefined conditions are met, reducing the need for intermediaries. This leads to decreased processing times and lowered costs associated with traditional methods. Blockchain also opens possibilities for cross-border lending by simplifying currency exchange and compliance processes. By embedding these advanced features, blockchain is poised to revolutionize traditional lending, creating systems that are not only more efficient but also more safeguarded against fraud and other malicious activities.

Mobile Platforms Revolutionizing Accessibility

Mobile platforms have revolutionized the accessibility of loan applications by putting financial services literally at users’ fingertips. The proliferation of smartphones and mobile banking apps has enabled borrowers to apply for loans anytime, anywhere, without having to visit a physical branch. Mobile apps provide user-friendly interfaces, which simplify the application process, allowing users to complete document submissions and track application statuses in real-time. The convenience of these platforms has led to increased engagement and utilization, particularly among younger and tech-savvy demographics. Lenders benefit from the data insights garnered from mobile interactions, which inform customer behavior and preferences. Additionally, mobile platforms facilitate enhanced communication between lenders and borrowers through instant messaging and notifications, leading to improved customer service. By advancing accessibility and user experience, mobile platforms are driving the democratization of financial services, ensuring that loans are available to a more diversified audience.

The Impact of Fintech Innovations

Fintech innovations have profoundly impacted the loan approval process by introducing new technologies and business models. Fintech companies leverage advanced analytics, open banking, and APIs to create more efficient and customer-centric lending experiences. These innovations allow for more comprehensive evaluations of borrowers by incorporating alternative data sources such as utility payments and digital footprints. By utilizing digital platforms, fintech firms can deliver personalized loan options and faster approval times, adapting swiftly to changing consumer expectations. The competitive nature of fintechs drives traditional lenders to modernize their services and embrace digital transformation. Moreover, fintech innovations contribute to financial inclusion by providing access to credit for underserved populations, fostering economic mobility. As fintech continues to evolve, its emphasis on speed, transparency, and customer-focused solutions reshapes the financial landscape, making loan approval processes more agile, inclusive, and aligned with the demands of the digital age.

Future Trends: Predictive Analytics and Beyond

The future of loan approval processes lies in predictive analytics and beyond, promising even more personalized and efficient lending experiences. Predictive analytics uses historical and real-time data to forecast borrowers’ credit behavior, enabling lenders to anticipate and mitigate risks preemptively. This approach allows for proactive loan management, optimizing repayment schedules and credit terms to suit individual borrower profiles. Beyond predictive analytics, the integration of advanced technologies such as the Internet of Things (IoT) and augmented reality (AR) has potential applications in financial services, offering innovative approaches to risk assessment and customer engagement. As technology continues to evolve, future loan approval processes will likely emphasize hyper-personalization, leveraging data to create bespoke financial solutions. These advancements will not only enhance lenders’ decision-making capabilities but also empower borrowers with greater control over their financial futures, paving the way for a more dynamic and responsive financial ecosystem.